In today’s threat landscape, cybersecurity alone isn’t enough — organisations need financial resilience too. KavachSure by LNN Evara Advisors goes beyond risk mitigation to offer strategic coverage aligned with your digital posture. Whether you're navigating ransomware threats, data breaches, or system outages, we help you prepare for the financial consequences before they occur.

Our advisory-led model begins with a Cyber Insurance Risk Analysis that quantifies your exposure, identifies coverage gaps, and recommends optimised plans. We factor in sector-specific risks, regulatory expectations, and your existing cybersecurity maturity. The result is an insurance strategy tailored to your business model — not a one-size-fits-all policy.

KavachSure is ideal for BFSI, fintech, and automotive clients with critical digital infrastructure. From incident response readiness to coverage planning and impact estimation, we ensure your insurance framework protects not just your data, but your balance sheet.

Why choose cyber insurance?

Cyber Insurance is essential for modern businesses navigating digital transformation. As cyberattacks become more frequent and sophisticated, a tailored cyber insurance plan ensures your organisation is financially protected against unforeseen breaches, downtime, and data loss.

Financial Protection Against Cyber Losses

Minimise monetary damage from breaches, ransomware, and regulatory penalties with customisable coverage.

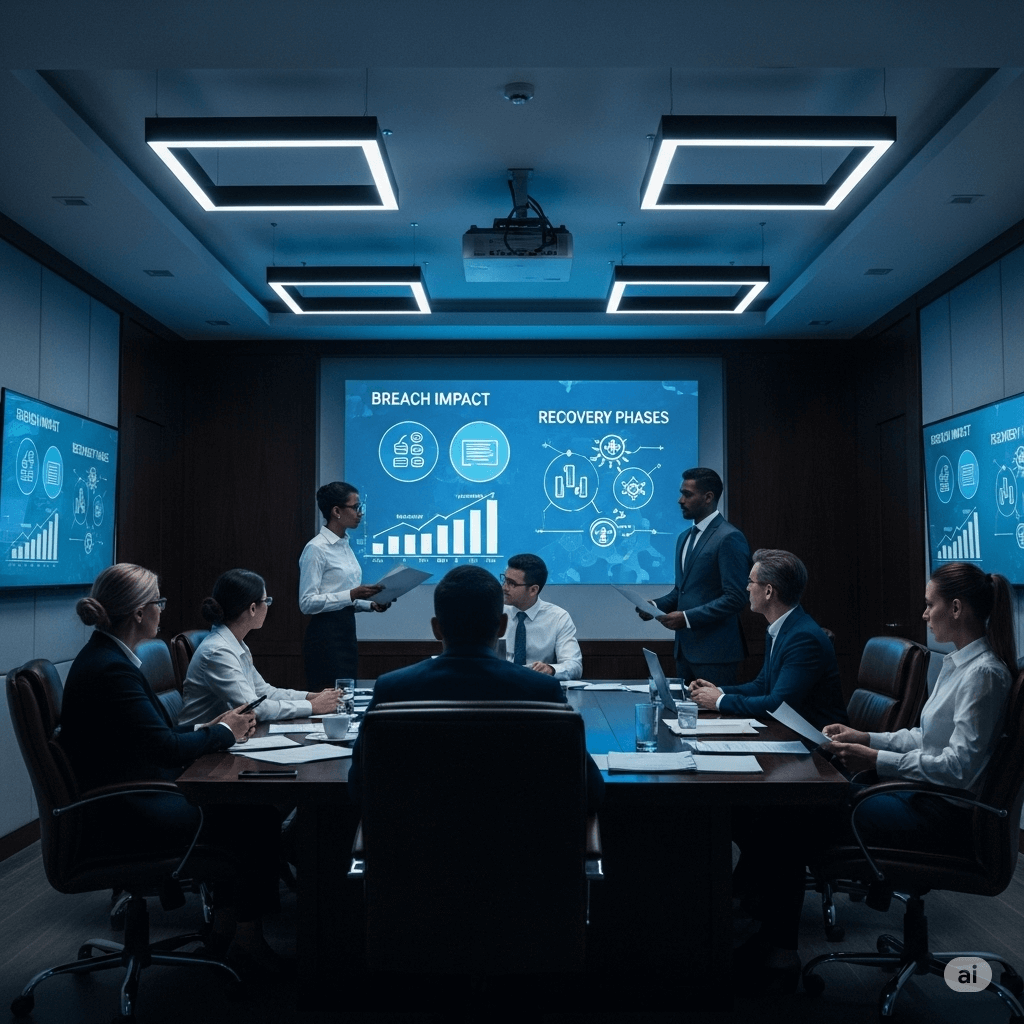

Incident Response & Recovery Support

Access expert response teams to assist during and after a cyber incident, ensuring faster recovery.

Risk-Aligned Coverage Plans

Get insurance solutions aligned with your specific cyber risk profile, infrastructure, and business size.

Regulatory Compliance Support

Meet legal and compliance requirements with policies that include breach notification and data loss clauses.

It offers comprehensive coverage for financial losses, operational downtime, legal liability, and reputation damage. With evolving cyber threats, insurance isn't optional — it's strategic.

Feature of Cyber Insurance

Provides financial risk mitigation, breach response support, legal liability protection, and reputational risk coverage — all aligned with your evolving threat landscape to ensure quick recovery and business continuity.

Risk-Based Premium Calculation

Policies are tailored to your actual threat exposure, infrastructure, and sector-specific vulnerabilities.

Incident Response Planning

Includes access to expert teams for real-time breach support and coordinated response.

Legal & Regulatory Support

Coverage includes legal liability, data breach notification costs, and assistance with regulatory claims.

Provides immediate support after cyber incidents — from legal counsel and financial recovery to PR assistance — enabling faster bounce-back from disruptions.

- Tailored Risk Coverage

- Legal Support & Advice

- Post-Breach Crisis Management

- Reputation Protection

Frequently asked questions

Cyber insurance covers expenses related to data breaches, ransomware attacks, legal liabilities, regulatory fines, PR crises, and operational disruptions.

Absolutely. Cyber risks are not limited to large enterprises. Small and medium businesses are often targeted and can benefit significantly from financial and legal protection.

Premiums are typically based on your industry, security posture, historical incidents, regulatory environment, and the size of your digital footprint.

Many cyber insurance policies offer coverage for regulatory fines and legal defence, depending on the terms and local laws. It’s important to choose a policy aligned with your compliance landscape.

Most plans include access to forensic investigators, legal experts, public relations teams, and breach response coordinators to manage the crisis and minimise damage.